Why the recent price adjustment of stainless steel in stock is smaller than that of futures.

Release time:

2023-06-19

Since June 1., the market has fluctuated and risen, while in stock prices have only slightly adjusted.

Recently influenced by macro positive factors at home and abroad, Shanghai Nickel andStainless Steel FuturesAs of the close of June 16, the main stainless steel contract closed at 15255 yuan/ton, up 60 yuan/ton, a daily increase of 0.39, up 600 yuan/ton from May 31.

On the other hand, in stock rose significantly weaker than futures:

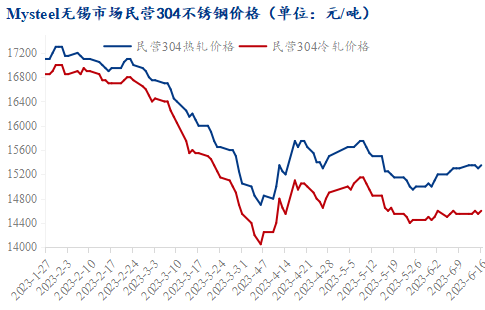

304 private coldhot rollingThe price rose only 100-200 yuan/ton in the month. As of 4: 00 p.m. on the 16th, private 304cold rollingMao-based mainstream price to 14950-15050 yuan/ton, private hot-rolled resources five-foot rough edge mainstream price to 14550-14650 yuan/ton, the range of change is significantly smaller than the futures price.

2. social inventories are low and traders have a strong willingness to support prices.

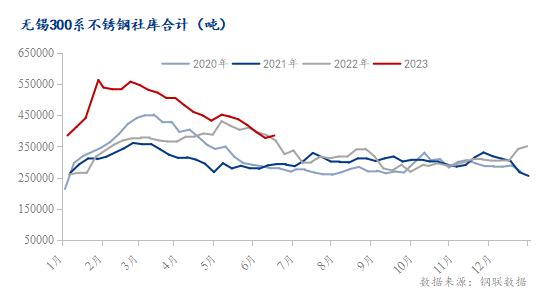

AccordingMysteelData: as of June 15, noneTinThe market 300 was 385100 tons of social inventories, up 2.10 percent from the previous week. Among them, 300 cold-rolled weekly increased by 1.11. Most of the arrival of large plants in North China and northwest of the arrival of resources, private steel mills less arrival resources.

In terms of data, the year-on-year inventory level is high, because: since January 5, 2023, Wuxi area stainless steel social inventory sample update a total of 12 new, through historical data show that the new sample accounted for about 10% of the original warehouse caliber, year-on-year increase is a normal phenomenon.

According to market feedback, since May, traders' sales have declined, but due to the slowdown in the pace of steel mill shipments, the overall low level of inventory at the trade end; in addition, traders are supported by the cost of holding goods, the willingness to stock up and ship at reduced prices is low, so the recent volatility of in stock prices is limited.

3. traders hold high costs of goods, low willingness to ship at reduced prices

Steel mill prices have been raised this week:

As for East China steel mills, this week's 304 stainless steel cold rolling opened at 15200 yuan/ton for four feet and 15300 yuan/ton for five feet, both up 100 yuan/ton from last week; 304 hot rolling opened at 15000 yuan/ton, up 100 yuan/ton from last week; Shandong steel mills opened 15100 yuan/ton for 304 hot rolling this week, up 200 yuan/ton from last week.

The steel mill price is higher than the market sales price, plus the agent 100-200 yuan/ton sales cost, higher holding, sales, capital costs, even if the transaction within the week is not good, but the agent's overall willingness to let the shipment is not high, more stable price, the actual single there is a small profit space.

Summary:AccordingAccording to market feedback, traders' sales have declined since May, but due to the slowdown in the delivery pace of steel mills, the overall low inventory at the trade end and strong willingness to support prices; In addition, under the support of traders' costs, the willingness to stock up and ship at reduced prices is relatively low. Therefore, the recent fluctuation of in stock prices is limited, and the delivery and demand of steel mills need to be continued.

More news